The path to a “soft landing” does not look as smooth as it did four months ago. But the expectations of a year ago have been exceeded.

The economic news of the past two weeks has been enough to leave even seasoned observers feeling unmoved. The unemployment rate fell. Inflation increased. The stock market plunged, then recovered, then fell again.

Step back, however, and the image comes into sharper focus.

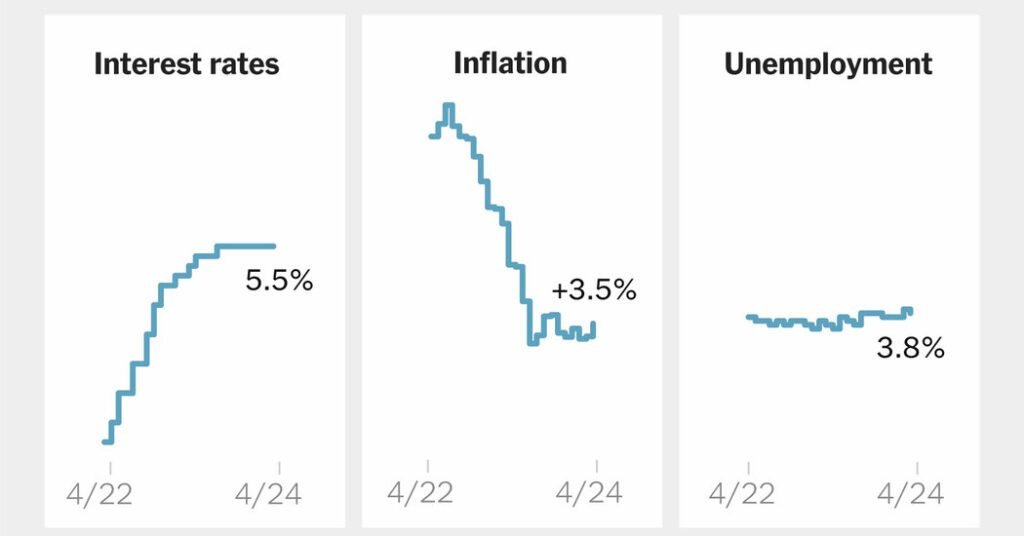

Compared to the outlook in December, when the economy appeared to be on a glide path to a surprisingly smooth “soft landing,” recent news has been disappointing. Inflation has proven more stubborn than expected. Interest rates are likely to remain at their current levels, the highest in decades, at least through the summer, if not into next year.

Shift the point of comparison back a bit, however, to early last year and the story changes. At the time, forecasters widely predicted a recession, convinced that the Fed’s efforts to control inflation would inevitably lead to job losses, bankruptcies and foreclosures. And yet inflation, even with its recent hiccup, has eased significantly, while the rest of the economy has so far escaped significant damage.

“It seems crazy to complain about where we are right now,” said Wendy Edelberg, director of the Hamilton Project, an economic policy arm of the Brookings Institution. “This was a really remarkably painless slowdown, given what we were all worried about.”

Monthly swings in consumer prices, employment growth and other indicators matter a lot to investors, for whom every hundredth of a percentage point in Treasury yields can affect billions of dollars in trades.

But for almost everyone else, what matters is somewhat longer duration. And from that perspective, the economic outlook has changed in some subtle but significant ways.

Inflation is persistent, not rising.

Inflation, as measured by the 12-month change in the Consumer Price Index, peaked at just over 9 percent in the summer of 2022. The rate then fell sharply for a year, before easing to around 3.5 percent in recent months . An alternative measure preferred by the Fed shows lower inflation — 2.5 percent in the latest data, from February — but a similar overall trend.

In other words: Progress has been slowed, but not reversed.

On a monthly basis, inflation has risen slightly since late last year. And prices continue to rise rapidly in certain categories and for certain consumers. Car owners, for example, are being hit by a triple whammy of higher gas prices, higher repair costs and, most notably, higher insurance rates, which have risen 22 percent in the past year.

But in many other areas, inflation continues to ease. Food prices have been flat for two months and have risen just 1.2 percent over the past year. Prices on furniture, home appliances and many other durable goods have fallen. Rent increases have moderated or even reversed in many markets, although this has been slow to show up in official inflation data.

“Inflation is still very high, but inflation is much less broad than it was in 2022,” said Ernie Tedeschi, a researcher at Yale Law School who recently left a post in the Biden administration.

The rest of the economy is doing well.

The recent flattening of inflation would be a major concern if it were accompanied by rising unemployment or other signs of economic trouble. That would put policymakers in a bind: Try to prop up the recovery and they could risk adding more fuel to the inflation fire. continue to try to reduce inflation and could push the economy into recession.

But that’s not the case. Outside of inflation, most of the recent economic news has been reassuring, if not entirely rosy.

The labor market continues to beat expectations. Employers added more than 300,000 jobs in March and have added nearly three million over the past year. The unemployment rate has been below 4 percent for more than two years, the highest since the 1960s, and layoffs, despite cutbacks at some high-profile companies, remain historically low.

Wages are still rising – no longer at the breakneck pace of the previous recovery, but at a rate that is closer to what economists consider sustainable and, crucially, faster than inflation.

Rising earnings have allowed Americans to continue spending even as the savings they built up during the pandemic have dwindled. Restaurants and hotels are still full. Retailers are coming off a record holiday season and many are predicting growth again this year. Consumer spending helped accelerate overall economic growth in the second half of last year and appears to have continued to rise in the first quarter of 2024, albeit at a slower pace.

At the same time, sectors of the economy that struggled last year are showing signs of recovery. Single-family home construction has picked up in recent months. Manufacturers are reporting more new orders and plant construction has soared, in part because of federal investment in the semiconductor industry.

Interest rates will remain high for a while.

Therefore, inflation is very high, unemployment is low and growth is stable. With this set of ingredients, the standard policymaking cookbook offers a simple recipe: high interest rates.

To be sure, Fed officials have signaled that rate cuts, once expected by investors early this year, are now likely to wait until at least the summer. Fed chair Michelle Bowman has even suggested that the central bank’s next move could be to raise interest rates rather than cut them.

Investors’ expectation of lower interest rates was a major factor in equity price movements in late 2023 and early 2024. That rally has lost steam as the outlook for rate cuts darkened and further delays could create problems for equity investors. Major stock indexes fell sharply on Wednesday after an unexpectedly hot Consumer Price Index report. The S&P 500 ended the week down 1.6%, its worst week of the year.

Borrowers, meanwhile, should wait for any relief from high interest rates. Mortgage rates fell late last year in anticipation of rate cuts, but have since rebounded, exacerbating the existing housing affordability crisis. Interest rates on credit cards and auto loans are at their highest levels in decades, which is especially difficult for lower-income Americans, who are more likely to rely on such loans.

There are signs that higher borrowing costs are starting to take their toll: Delinquency rates have risen, particularly for younger borrowers.

“There are reasons to be concerned,” said Karen Dinan, a Harvard economist who was a Treasury official under President Barack Obama. “We can see that there are segments of the population that for one reason or another are under pressure.”

Overall, however, the economy has withstood the harsh medicine of higher interest rates. Bankruptcies and consumer foreclosures haven’t skyrocketed. No business failures either. The financial system is not as bent as some feared.

“What should keep us up at night is if we see the economy slowing but the inflation numbers not slowing,” said Ms. Edelberg of the Hamilton Project. So far, however, this has not happened. “We still have really strong demand and we just need monetary policy to stay tighter for longer.”