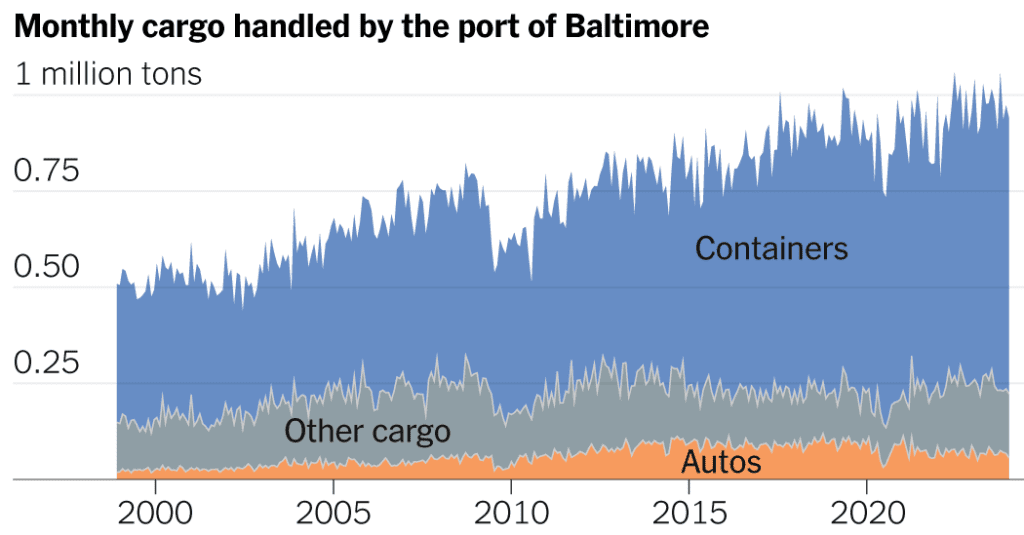

Baltimore ranks first in the United States for the volume of cars and light trucks it moves and for vessels carrying wheeled cargo, including farm and construction machinery, according to a statement from Maryland Gov. Wes Moore last month.

The incident is another stark reminder of the vulnerability of the supply chains that transport consumer products and goods around the world.

The extent of the disruption depends on how long it takes to reopen shipping channels at the Port of Baltimore. Experts estimate that it may take several weeks.

Baltimore is not a top port for container ships, and other ports likely can absorb the traffic that was headed for Baltimore, industry officials said.

Steven Edwards, CEO of the Port of Virginia, said he expects a ship on Tuesday that was previously bound for Baltimore and that more will follow soon. “Between New York and Virginia, we have sufficient capacity to handle all that cargo,” Mr. Edwards said, referring to container ships.

“Shipping companies are very flexible,” said Jean-Paul Rodrigue, a professor in the shipping business administration department at Texas A&M University-Galveston. “In two to three days, it will be rerouted.”

But other types of cargo could remain grunts.

Alexis Ellender, global analyst at Kpler, a commodities analysis firm, said he expects the port closure to cause a significant disruption to US coal exports. Last year, about 23 million metric tons of coal exports moved through the Port of Baltimore, about a quarter of all U.S. coal shipments by sea. About 12 ships were expected to leave the port of Baltimore in the next week or so carrying coal, according to Kpler.

He noted that it would not cause a huge blow to the global market, but added that “the impact is significant for the US in terms of the loss of export capacity.”

“You may see coal loads coming from the mines being re-routed to other ports,” he said, with Norfolk, Va., the most likely port.

If auto imports decline since the Baltimore shutdown, inventory could run out, particularly for models that are in high demand.

“We are beginning discussions with our various transportation providers regarding contingency plans to ensure an uninterrupted flow of vehicles to our customers and will continue to closely monitor this situation,” Stellantis, which owns Chrysler, Dodge, Jeeps and Rams.

Other ports have the ability to import cars, but there may not be enough car carriers at those ports to handle the new traffic.

“You have to make sure the capacity is there all the way through the supply chain — all the way to the dealership,” said Mr. Golara, the Georgia State professor.

One looming battle is insurance payouts, once legal liability is determined. The size of the payment by the insurer is likely to be significant and will depend on factors such as the value of the bridge, the scale of compensation for loss of life due to the families of the people who died, damage to the ship and port disruption.

The ship’s insurer, Britannia P&I Club, a member of a global group of insurance companies, said in a statement that it was “working closely with the ship’s manager and the relevant authorities to establish the facts and ensure that this situation is dealt with quickly and professionally. .”

The port is also increasingly serving large container ships such as the Dali, the 948-foot-long cargo ship carrying cargo for shipping giant Maersk that hit a bridge pier around 1:30 a.m. on Tuesday. The Dali had spent two days in Baltimore Harbor before heading to the 1.6-mile Francis Scott Key Bridge.

State terminals, operated by the Maryland Ports Authority, and private terminals in Baltimore handled a record 52.3 million tons of foreign cargo in 2023, valued at $80 billion.

Materials transported in large volumes through the city’s port include coal, coffee and sugar. It was the ninth busiest port in the country last year for receiving foreign cargo, in terms of volume and value.

The bridge collapse will also disrupt cruise lines traveling in and out of Baltimore. Norwegian Cruise Line last year launched a new fall and winter schedule with the Port of Baltimore.