Less than four weeks after a hole opened in a Boeing 737 Max 9 aircraft during a flight, company executives are facing a thorny question: Should they focus on safety or financial performance?

The issue comes as Boeing prepares to report fourth-quarter earnings on Wednesday amid its most significant safety crisis in years. With the Jan. 5 incident on a Max 9 flight still under investigation, executives are grappling with how much to discuss quality control while reassuring shareholders that the company is protecting their investment, according to two people with knowledge of the matter.

The National Transportation Safety Board is expected to release a preliminary report this week on the incident, which occurred on an Alaska Airlines flight. The report could shed more light on how a panel exploded on the Max 9 and is almost certain to intensify scrutiny of Boeing from lawmakers, airlines and safety groups.

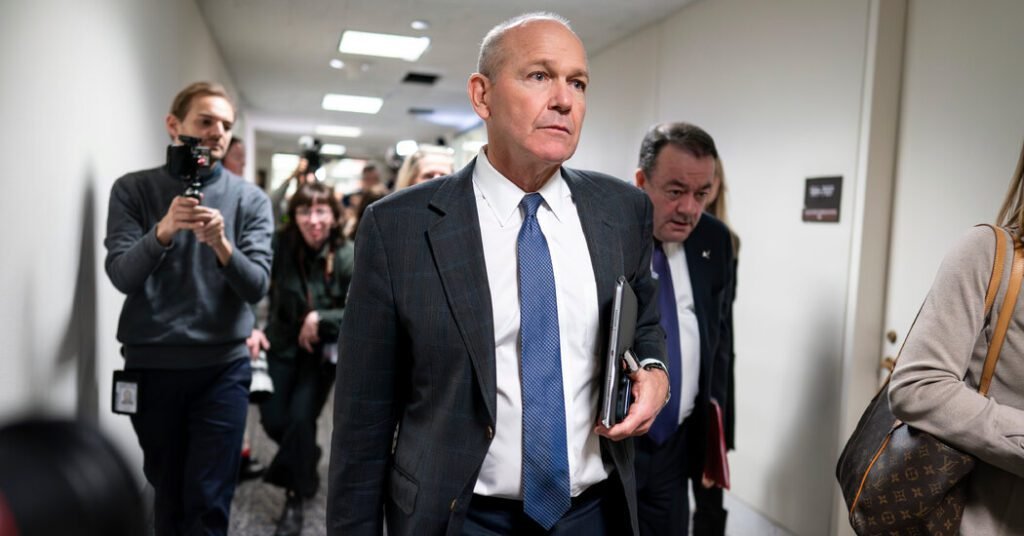

Dave Calhoun, Boeing’s chief executive, is expected to talk about safety during the company’s call with investors Wednesday morning after its earnings report, one of the people said. But it’s unclear what balance he and other executives will strike in their comments as they try to contain the fallout from the Max 9 incident.

The issue has gained new prominence after news accounts, including a report in the New York Times, that Boeing workers opened and then reinstalled the panel, known as a door plug. The plug tore from the Alaska plane shortly after takeoff. That revelation suggests the incident — which terrified passengers and forced the pilots to make an emergency landing — may have been caused by errors at a Boeing factory in Renton, Washington.

Some aviation experts and executives have long said that Boeing’s safety problems and its financial performance are intertwined. The company, these people say, has for years placed too much emphasis on growing profits and enriching shareholders with dividends and share buybacks, and not enough on investing in engineering and safety.

Boeing’s emphasis on rewarding investors has led to quality and safety problems, its critics say, including two deadly crashes of the 737 Max 8 plane in 2018 and 2019 that killed nearly 350 people. Those accidents and the effects of the coronavirus pandemic, in turn, hurt Boeing financially and allowed its main competitor, Airbus, to outsell it.

“Lately, Boeing has been appointing CEOs who seem more focused on stock price and dividends than flight safety and production quality,” said Dennis Tajer, an American Airlines captain and spokesman for the union that represents the airline’s pilots. .

Boeing declined to comment.

How Boeing deals with its latest crisis in the coming weeks and months could have broad implications for its credibility with regulators, airlines and travelers, as well as its long-term financial performance.

Investors worry that this latest crisis could derail Mr. Calhoun’s plans to put Boeing on a firmer financial footing. The company’s share price has fallen about 19% since January 5.

Airline executives, federal regulators and safety groups have expressed growing frustration with Boeing and its repeated safety problems.

Mr Calhoun, who took over as chief executive in January 2020 after serving on the company’s board for years, promised at the time that the company would be “better” and held “accountable to the highest standards of safety and quality”.

Robert Isom, the chief executive of American Airlines, told Wall Street analysts last week that “Boeing needs to get its act together.” He added, “The issues that they are dealing with in the recent period of time, but also many years back, are unacceptable.”

Adding to the sense of urgency for Boeing, the Federal Aviation Administration said last week it was restricting Boeing’s ability to ramp up production of all 737 Max planes, including approving any additional assembly lines, until the company proves it has resolved the quality control issues. .

The agency has allowed the Max 9 planes it grounded after the Alaska incident to continue flying after inspections. United Airlines and Alaska, the only two US airlines flying the Max 9, have in recent days begun using the planes again.

Federal investigators are focused in part on whether the two pairs of bolts that were supposed to hold the door plug in place on the plane’s body were installed. No bolts have been recovered.

The circumstances of the Alaska Airlines incident are different from those of the Max 8 crashes: no serious injuries were reported, and the issue appears to be one of construction rather than design. But Boeing’s approach in its April 2019 quarterly earnings report, just weeks after the second Max crash, may serve as a template for Boeing executives on Wednesday.

During that earnings call, Dennis Muilenburg, then the company’s CEO, spent several minutes talking about safety and quality rather than Boeing’s financial performance.

“Recent events have been a profound reminder of the importance of our enduring values at Boeing: safety, quality and integrity, even more so in the challenging times we now face,” Mr. Muilenburg said at the start of the call. “Our work demands the utmost perfection.”

Analysts expect Boeing to seek to reassure stakeholders about its commitment to safety.

“In our view, investors are a secondary audience for Wednesday’s call, as regulators, members of Congress and their staff, the press and the public are all key constituencies that Boeing needs to reach, with a focus on likely safety and quality assurance procedures,” JP Morgan analysts wrote in a note on Monday.

Mr. Calhoun has suggested he is not focused on Boeing’s financial performance right now.

“This is not the time to talk about what I can or can’t achieve in terms of deliveries,” he told CNBC on Jan. 10 when asked about ramping up production of the Max planes. “My job right now is solely focused on, let’s understand and fix the security issue.”

Peter Eavis contributed to the report.