When New York magazine’s financial advice columnist published an article that went viral on Thursday about being the victim of a $50,000 scam, my heart sank.

My own financial planner had gone to jail years ago, which I had chronicled in a few columns. Almost all of us are vulnerable to scams, at least sometimes. What would I do if someone called and insisted that my children, in particular, were in serious danger?

The author, Charlotte Cowles, who once had a weekly business column with the New York Times, described scammers as telling a fictional story: First, they impersonated Amazon and told her she had been a victim of identity theft. A thief then handed her over to someone posing as a Federal Trade Commission investigator, who told her that nine vehicles, four properties and 22 bank accounts were registered in her name. Eventually, a supposed CIA “chief investigator” convinced her to withdraw money from her bank and put it in safekeeping while her husband and son watched.

But what would any of these entities do if they thought they were one of us actually victim of some kind of identity fraud? What would they say, ask and tell us to do?

I called them all and asked. Here’s what they said.

Amazon does not have a direct line with the Federal Trade Commission.

Ms Cowles’ story begins with a call in October purporting to be from Amazon, when a woman on the line told her about $8,000 in fraudulent purchases and said she was a victim of identity theft.

The woman then offered to link Ms. Cowles to Amazon’s link to the FTC. Soon, it was on the line.

However, Amazon does not refer customers to the FTC or any other government agency, according to Tim Gillman, a spokesman.

The company sometimes calls people to verify account activity, which will likely be much harder to do as Ms. Cowles’ story continues to go viral. But if your call seems hopeful, just hang up and reach out directly through the Amazon app or website.

“Don’t call numbers sent via text or email or found in online search results,” added Mr Gilman. And if anyone suggests you download or install Amazon’s customer service software, don’t.

The FTC will not offer a badge number.

Once Ms. Coles got on the phone with the supposed FTC investigator, he offered his badge number and asked about the contents of her bank account.

On Thursday afternoon, Lina Khan, chairman of the Federal Trade Commission, posted on X: “Being a victim of fraud can be devastating. A reminder that no one at the @FTC will ever give you a badge number, ask you to confirm your social security number, ask you how much money you have in your bank account, transfer you to a CIA agent, or send you messages out of the blue.”

Coincidentally, the FTC on Thursday finalized a new rule that gives it more powerful tools to fight criminals impersonating businesses. Consumers reported fraud losses of more than $10 billion for the first time in 2023, according to the agency, up 14 percent from the previous year.

Last month, the FTC issued a warning about scammers trying to get you to move your money somewhere safer. It sounded a lot like what had already happened to Ms. Coles.

The CIA probably isn’t going to call you.

Before getting her to move her money, the FTC impersonator wanted to hand her over to the lead investigator on her case, who allegedly worked for the CIA. She had her doubts, but called what she thought was the FTC’s main phone number.

He thought he might be “spoofing”, using tools to pretend he was actually calling from that number. But he quickly moved on, telling her not to tell her husband or a lawyer about the situation. Soon, the exchange turned to freezing her assets and issuing a replacement social security number.

“The CIA is a foreign intelligence organization. That’s just not the kind of thing we’re going to get involved in,” a CIA spokesman said.

The CIA website makes a few points that are relevant. The agency collects foreign intelligence and conducts covert action. “We are not a law enforcement agency,” the site says. And while it may work with law enforcement entities, it tends to be about issues like counterintelligence and terrorism.

Its FAQ goes into even more detail, noting that it “does not require employees/contractors to receive assurances of money or any personal information (such as social security number, driver’s license or banking information) to initiate a relationship” .

However, Ms Cowles’ contact told her to go to her bank and withdraw $50,000 — and not tell the bank why.

Banks may not stop you from walking out of their branches with a backpack full of $100 bills.

Ms. Coles did as her CIA follower told her. At a Bank of America branch, someone led her up a flight of stairs, where a teller handed over the money and a piece of paper with some scam warnings.

“Going in, I honestly hoped they would say no to my withdrawal or make me wait, but they didn’t,” Ms. Cowles told me via email. “The fraud alert gave me pause, but because the scammers hadn’t told me to hand over the money yet to them, I didn’t feel like it really applied to my situation. In addition, I was so terrified of what would happen if I didn’t follow the instructions that I was beyond my skepticism.”

Ms. Cowles is not a senior citizen. If it was, maybe the bank teller would have slowed things down. Banks are very concerned about senior fraud and will close any account a person has if they suspect anything innocuous.

Ms. Cowles said she did not hold it against Bank of America since it was actually her money she was withdrawing. But do banks usually hand over large amounts of cash?

“We make extensive efforts to warn customers about avoiding fraud,” Bank of America spokesman William P. Halldin said in an email. The bank declined to comment further.

“We are not restricting customers from accessing their money,” Justin K. Page, a Chase spokesman, said via email. “However, there are cases where funds are held for additional verification. This includes cases where one of our bankers suspects that our customer may be accompanied by someone who appears to be pressuring them. We train our bankers to look for it.”

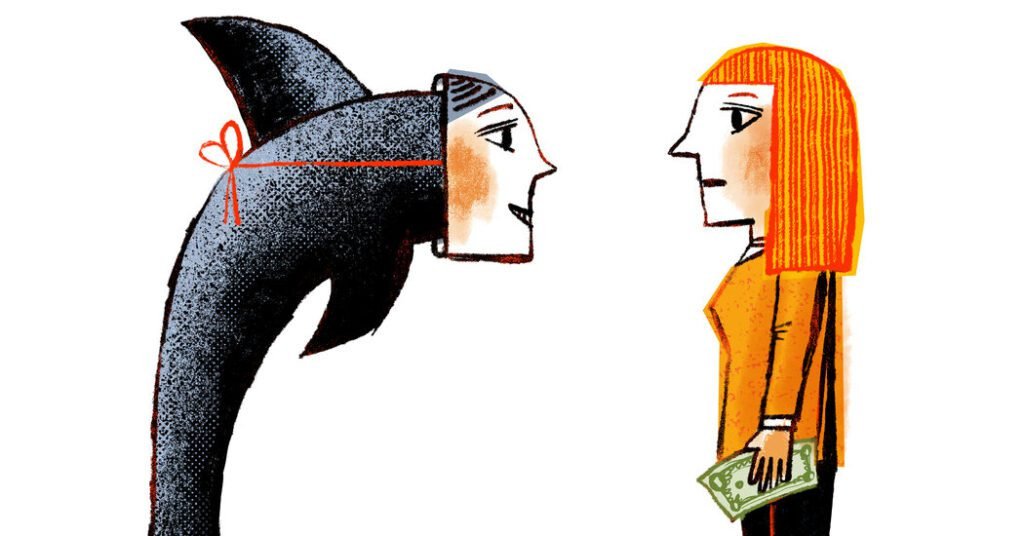

Hijackers are in the brain, not the planes.

The thief posing as the CIA agent eventually told Mrs. Cowles to hand over the cash. After all, he said, he was going to be charged with money laundering. Allowing the agency to convert the money into a government check using her new Social Security number would net her $50,000.

That sounds absurd. However, it also created a conflicting internal dialogue.

“People who have always used their brains don’t pay attention to their emotions, and I think we need to pay attention to what our bodies are telling us,” said Amy Nofziger, director of fraud victim support for AARP’s Fraud Watch Network. “The gut is actually a scientific chemical dump. I have heard countless victims tell me, “My gut told me I shouldn’t do this, but my brain told me I should.”

Eva Velasquez, who has seen it all as president of the Identity Theft Resource Center, saw the situation in a similar way. “Bad actors steal our minds,” he said. “And it works, because we’re all, after all, human.”

Tara Siegel Bernard contributed to the report.