If the economy is slowing down, no one told the labor market.

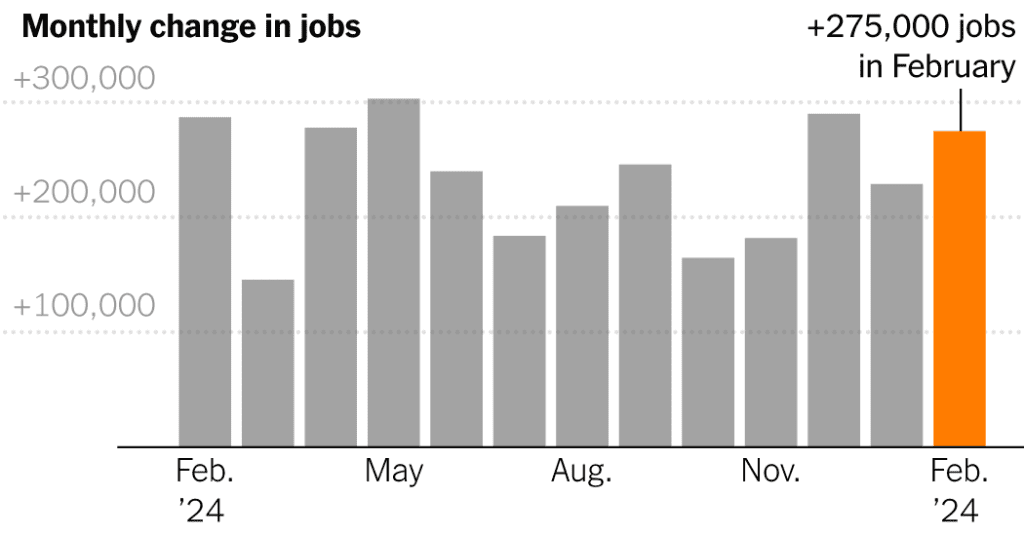

Employers added 275,000 jobs in February, the Labor Department said on Friday, in another month that beat expectations even as the unemployment rate rose.

It was the third straight month of gains above 200,000 and the 38th straight month of growth — fresh evidence that four years after the pandemic shut down, America’s jobs engine still has plenty of steam.

“We expected a slowdown in the labor market, a further easing of conditions, but we’re just not seeing it,” said Rubeela Farooqi, chief economist at High Frequency Economics.

The previously reported figures for December and January were revised down by a total of 167,000, reflecting the higher degree of statistical variability in the winter months. This does not disrupt the picture of consistent, strong increases.

At the same time, the unemployment rate, based on a survey of households rather than businesses, rose to a two-year high of 3.9%. The increase from 3.7 percent in January was due to people who lost or left jobs as well as those who entered the labor force to look for work.

A more expansive measure of slack labor market conditions, which includes people who work part-time and prefer to work full-time, rose steadily and now stands at 7.3 percent.

On a positive note, the labor force participation rate for people in their prime working years – ages 25 to 54 – jumped to 83.5 percent, matching a level from last year that was the highest since the early 2000s .The participation rate for people over 55 remains markedly below pre-pandemic levels, possibly in part because the housing and stock market booms have allowed more people to retire.

Average hourly earnings rose 4.3 percent over the year. Wages have outpaced prices since last May, although the pace of increases is weakening.

“Recently we’ve seen gains in real wages and that’s encouraged people to get back into the labor market, and that’s a good development for workers,” said Kory Kantenga, senior economist at job search site LinkedIn. As wage growth slows, he said, the likelihood that more people will start looking for work decreases.

Until last fall, economists were predicting much more modest job gains, with hiring concentrated in a few industries. Some pandemic-swelling industries have lost jobs, but expected declines in sectors such as construction have not materialized.

The past few months have been filled with strong economic data, prompting analysts surveyed by the National Association for Business Economics to raise their forecasts for gross domestic product and lower their expectations for the trajectory of unemployment. Inflation has eased, leading the Federal Reserve to telegraph plans for rate cuts sometime this year, which many see as insurance in case the labor market stumbles.

Mervin Jebaraj, director of the Center for Business and Economic Research at the University of Arkansas, helped record the survey responses. He said the mood was partly driven by waning concern about federal government shutdowns and draconian budget cuts, after several calls since the fall. And there’s no harm, he said, in a more subdued but more sustainable pace.

“If we gain 150,000 jobs every month this year, it would still be an incredible year, but it would still be more relaxed than last year,” Mr Jebaraj said. “And maybe we want both.”

In addition, some of the cooling may have allowed for more resistant growth. As extreme labor shortages eased and the wave of layoffs receded, employers unable to win the bidding wars for workers had an easier time filling positions. And as people live near them longer, productivity has improved, making it easier to pay more without raising prices.

Health care and government again led payroll gains in February, while construction continued its steady increase. Retail trade, restaurants, transportation and warehouses, which had been flat to negative in recent months, rose.

No major industry lost a significant number of jobs. However, high interest rates continued to suppress manufacturing, while credit intermediation continued its downward slide – the sector, which mainly includes commercial banking, has lost around 123,000 jobs since the start of 2021.

Few businesses are more emblematic of the force behind recent job gains from home health services for the elderly, which count for 164,000 more jobs than before the pandemic — fully offsetting the decline in nursing and home care facilities, which were less popular than Covid-19 broke them in 2020.

Elaine Flores is the CEO of Medical Home Care Professionals, a service in Redding, California, that employs 102 clinical staff members and caregivers. That’s up from about 20 percent since early 2020, though the net gain understates how many people it has had to hire as experienced providers have left the profession.

“More and more nurses are retiring,” Ms. Flores said. “This is probably the hardest industry to recruit, and we’re competing with hospitals, which have beautiful benefit packages that, on the home health side, we can’t do.”

Increased levels of immigration may help this problem in the coming years. The inflow over the past two years has roughly doubled the number of jobs the economy could add per month in 2024 without putting upward pressure on inflation, to a range of 160,000 to 200,000, according to an analysis by the Brookings Institution.

That’s not to say the employment landscape looks rosy for everyone. Employee confidence, as measured by company review site Glassdoor, has been steadily declining as layoffs at tech and media companies have hit the headlines. This is especially true in occupations such as human resources and consulting, while those in occupations that require personal work – such as health care, construction and manufacturing – are more optimistic.

“It’s a two-way job market,” said Aaron Terrazas, Glassdoor’s chief economist, noting that the job search takes longer for people with a bachelor’s degree. “For skilled workers in risk-intensive industries, anyone who’s been laid off has a hard time finding new jobs, while if you’re a front-line or service worker, it’s still competitive.”

Those struggling to find steady employment are increasingly turning to gigs, Mr. Terrazas noted, which is not reflected in the payroll data. That’s the case for Clifford Johnson, 70, who retired from his accounting job in Orlando, Fla., three years ago and started designing Social Security.

The perspective changed when Mr. Johnson separated from his husband and was forced to rent an apartment, which in Orlando’s hot housing market costs $2,350 a month. She hasn’t found another accounting job, and a retail position didn’t work out. He has outgrown his limited savings and currently drives for Uber Eats full-time—even on the weekend—to stay afloat.

“I just do what I can to make money every day,” Mr. Johnson said. He hopes they land some accounting contract positions, since driving so much is physically tiring. “If you’re 25 or just out of college, it’s a lot different than if you’re 70 and still trying to make a living.”

The path to the labor market, which few have been able to accurately predict, remains murky. Every apparent threat so far – including wars, substantial interest rate hikes and bank collapses – has been dealt with in an unacceptable manner.

Thomas Simons, senior economist at investment banking firm Jefferies, believes the economy will look weaker at the end of the year than it does now, despite the lack of obvious potholes.

“It’s been 30-plus years since we’ve had an economic cycle like this where we expect enough resistance to merge across different sectors to bring the whole number down,” Mr Simons said. “I still think it’s unlikely to continue indefinitely, even without a distinct catalyst.”